Multi-Family Investment For Sale

The Vine Financials

Property and Investment

Property: The Vine Modern 18-Plex Apartment, Building 3, a Class A multifamily investment.

Location: 266 N 590 E, Vineyard, UT (Utah County).

Year Built: 2017.

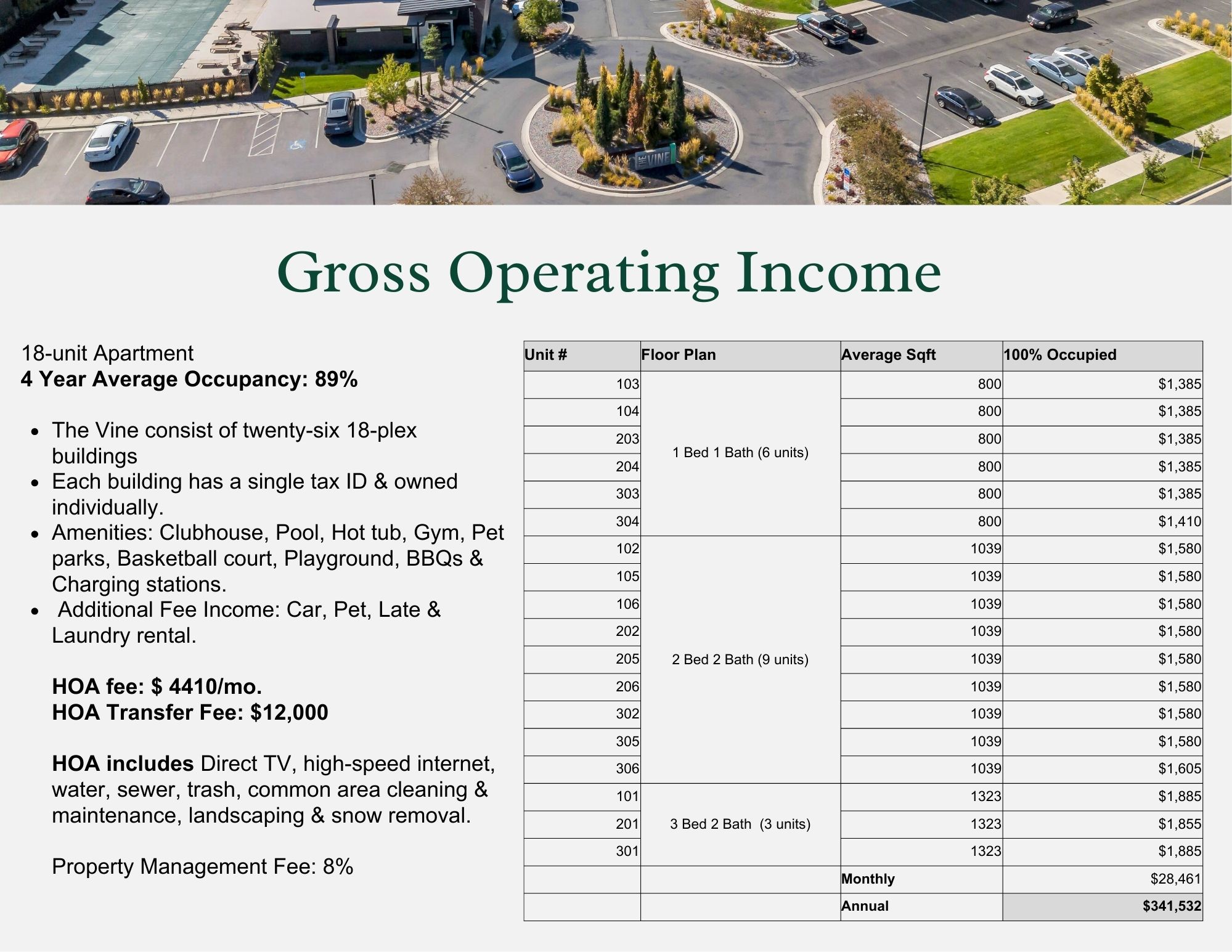

Units: 18 total (3 - 3 Bed/2 Bath, 9 - 2 Bed/2 Bath, 6 - 1 Bed/1 Bath).

Total Square Footage: 17,962 SF.

Purchase Price: $4.650,000.

Average Annual NOI (4-year average): $232,465

Current Occupancy: 89%.

Income Details

Gross Operating Income: $303,484

Occupancy Rate: 89%

Additional Fee Income: Car, Pet, Late, and Laundry fees.

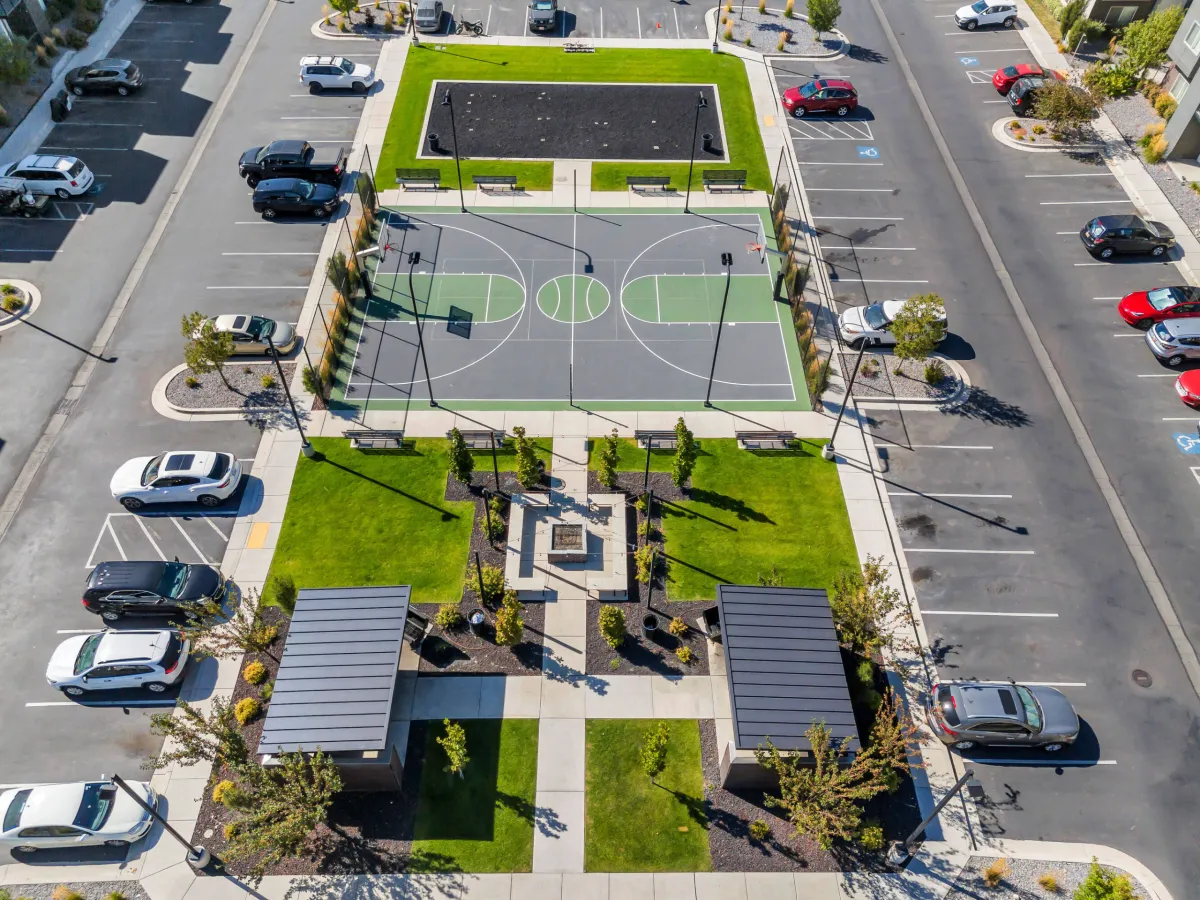

Amenities

Clubhouse, Pool, Hot tub, Gym, Pet parks, Basketball court, Playground, BBQs, and Charging stations. Includes Direct TV, high-speed internet, water, sewer, trash, common area cleaning, maintenance, landscaping, and snow removal.

Expenses and HOA

HOA Fee: $4,410/month. Includes: Direct TV, high-speed internet, water, sewer, trash, common area cleaning, maintenance, landscaping, and snow removal.

Property Management Fee: 8%.

Investment Advantages

Strong Growth: Located in Utah County ("Silicon Slopes") with strong growth due to population expansion, job creation (near Adobe, Microsoft, Amazon, etc.), and educational stability (near BYU & UVU).

Unique Financing: Benefit from the below-market assumable financing.

Low Risk: Sustained rent demand and low vacancy rates.